Remember when you bought the lot next door years ago? Your investment has finally come to fruition, but unfortunately the demand to buy it is annoying! The last thing you want to do is sell to the wrong person because:

We’ve been investing in Mecklenburg and its surrounding counties of North Carolina for the last 30 years because we believe selling your land should align with your values and get you the cash you need.

-Brent and Chandler Zande, Father/Son Team

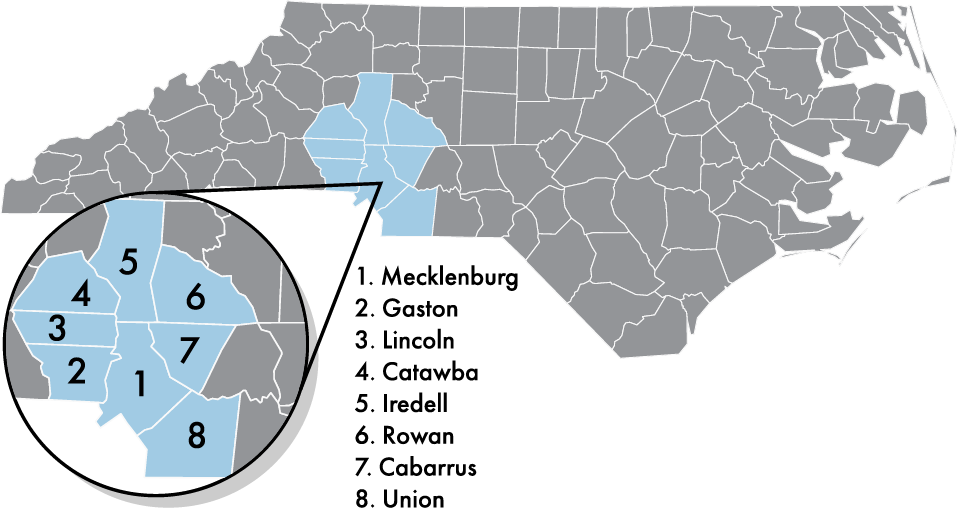

We are buying land in Mecklenburg County, NC and the surrounding area. If you have land in any of the areas highlighted below, schedule a call today!

Speak directly with our owner, Chandler, about your land.

We do our research and will make a fair cash offer.

When you get cash for the land that's been in your family for years, you can do the things you truly enjoy.

We understand the amount of time it has cost you caring for the extra lot that has been in your family for so long. Imagine what you can do in life when you get your time back and have available cash to finance your fun, family and priorities. The possibilites are endless!

Be confident about the decision you've made to sell your land. Here's our commitment to you:

Nobody likes to be insulted by playing number games. That's why when we give you an offer, you can simply tell us whether you like it or not. If you want to move on, we understand it may not be the right time for you to sell and that's ok by us.

Let's face it, there's a lot that goes into closing on the land we are buying from you and completing mounds of paperwork is the absolute worst! You shouldn't have to lift a finger once we agree on the purchase.In fact, we are often able to close on your property virtually so your time investment is minimal.

After we enter into a contract to purchase land, we know it will cause a little bit of inconvenience for you as we evaluate your land for closing. Because your time is valuable, we pay you a $500 due diligence fee as a thank you.

You’re not alone! Many of our past clients had questions as well. Here are a few of the most common questions we get asked and our answers. You can read all of our FAQs here.

A: Land contracts are similar to home buying contracts, but we make it even easier for you because we buy with cash, removing the hassle of banks from the process. We use a standardized form (Form 12-T) provided by the North Carolina Associate of Realtors and the North Carolina Bar Association. This contract documents the terms of purchase and sale of your land and helps to protect both parties in the event that the sale or purchase must be terminated. We do NOT use assignable or unofficial contracts at Slate Land Buyers, we are always the end buyer and will never assign your contract to another buyer. We also use a Closing Attorney that is experienced with land contracts, providing a simple, quick and easy closing process for you!

A: It depends! Each plot of land is different so we use public records, FEMA maps, topography data and dozens of other data points to make sure we’re offering you what your land is worth. Unlike other land buyers, we do our own research and compile an offer that is unique to your lot.

A: At Slate Land Buyers we cover all taxes and other closing costs associated with the sale of your land. There are never any hidden costs or fees when selling your land to us.

A: Because we are a direct buyer, the only documents you’re required to submit when selling land to us are filled out and signed copies of both the land purchase contract and a mineral, oil and gas disclosure which we provide. We have designed our process to be as simple and straightforward as possible, once both parties are in agreement on the offer we do the heavy lifting when it comes to the paperwork and will guide you through these few documents that you need to provide.

A: Working with a company experienced in buying land is generally the easiest way to sell your land quickly. Experienced land buyers, like Slate Land Buyers, can help you navigate the land selling process and ensure you get the best price for your land. We don’t charge you any fees or commissions like a realtor would, meaning you won’t have any out of pocket expenses which ensures you get every dollar that your land is worth.

In order to do that you need to sell your land. The problem is there are a lot of companies who want to buy your land which makes you feel apprehensive. We believe selling your land should align with your values and get you the cash you need.

We understand how cheap it can feel putting a price tag on something you’ve owned for so long. Which is why investing in our communities for the last 30 years is something my dad and I enjoy doing.

Go ahead and Schedule a Call so you can stop being annoyed by texts and phone calls from strangers who want to buy your land and instead provide for yourself the life you’ve imagined.

When you’ve owned land a long time there are many companies who will contact you repeatedly to buy it, but putting a price tag on your land feels cheap. We buy land in our own communities so that land owners feel valued and are able to provide for themselves the life they’ve always imagined.